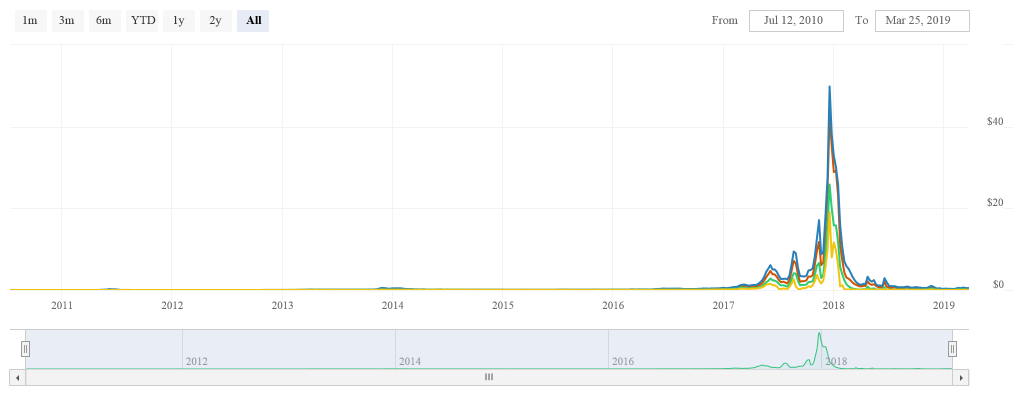

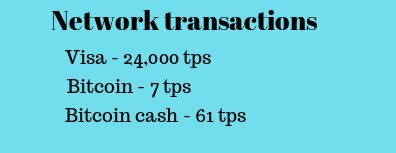

Satoshi Nakamoto, the infamous founder of Bitcoin, introduced Bitcoin for the first time in 2008. At that time he has been very active in online newsgroups. When Satoshi introduced the system for the first time to insiders the idea was welcomed with enthusiasm but also critics. James A. Donald, one of the first commenters, posted: “the way I understand your proposal, it does not seem to scale to the required size”. The reaction covered the scalability problem of the Bitcoin network. I think James A. Donald was right, because nowadays Bitcoin can’t handle more than 7 transactions per second. The Visa network, which handles the most financial transaction in the world today, covers about 1667 transaction per second. This a multitude of 238 times more in scale compared to Bitcoin. So why hasn’t Bitcoin gone away then after almost 10 years?

Borderless payment network

One of the reasons why is because now you have an alternative to the current financial system which is also borderless. Being borderless is very important because this gives the user control over his finances from everywhere in the world. Currently the Bitcoin network isn’t used heavily so you could say that it functions well compared to Visa. But what happens with the Bitcoin network when the network use gets too busy? As a result, transactions will take a long time to process and fees will go sky high.

If the Bitcoin network wants to be taken seriously as an alternative to the VISA payment processor it has to scale up. With only 7 TPS it does not even come close. This scalability issue of the Bitcoin network doesn’t come by surprise and has been discussed by the community from the beginning.

Lightning network: Fast transactions

This is one of the reasons why there are so many different other blockchains out there. According to Coinmarketcap there are 2108 currently. Despite this heavy competition in the crypto markets, the VISA network remains the biggest payment processor worldwide. There is, however, one proposed solution currently being tested that might just work. It’s called the Lightning Network.

The Lightning Network

So what’s the Lightning Network? The Bitcoin network in a current state can be well compared with how the former telegram network functioned back in the days. First, you had to go to a local postal office, fill in a form and pay for the message based on how many words it contained. After that, the message would get telegraphed to the nearest telegraph office. This office would be the nearest spot in the final destination of the message. Finally, a postman would deliver the telegram to its destination.

Deliver messages

You can say to deliver this message over the telegram network involves a lot of people. Even for very short messages, this was the way to go. Also, this way of messaging could be quite costly. The idea behind the Lightning Network is to be able to send short messages/transactions over the Blockchain network in a very efficient way.

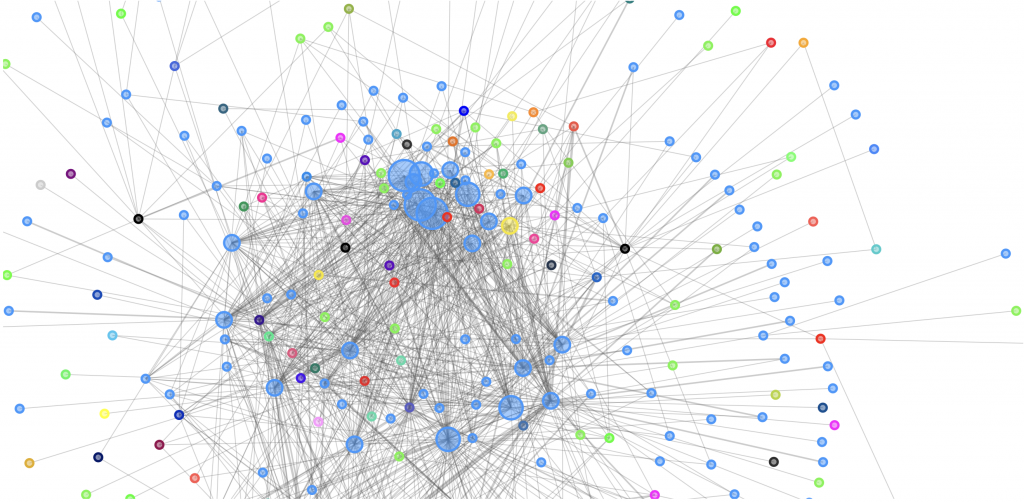

To put it simply, the idea is to not keep a record of every single transaction made on the Blockchain. The Lightning network will add another layer to Bitcoin’s Blockchain network. To start a transaction, users have to create payment channels between any two parties on that extra layer. After a channel is created, the channel will be up and running as long as required. These channels are set up between two users and thereby transactions will be instant and the transaction fees will go to almost zero.

How does it work?

Enter Laura and Roger. Whether they are co-workers, relatives or even a couple, the idea is that they need to send money to each other repeatedly, quickly and with minimal fees. By using the Lightning Network the right way, they have to set up a payment channel. Firstly they have to create a multi-signature wallet, which is a wallet that they both access with their private keys. After that, they both deposit a certain amount of Bitcoin – for example, 2 BTC each – into that wallet.

At this point, unlimited transactions can be done between the two of them. Essentially, these transactions are redistributions of the funds stored in the shared wallet. For instance, if Laura wants to send 1 BTC to Roger, she only has to transfer the ownership right of that amount to him. After this transaction-of-ownership, they sign this with their private keys and the balance sheet will be updated.

Payment channel

It’s very crucial to know that this transaction of ownership happens only in the channel between the two users. This is called an off-chain transaction. After the channel gets closed by one of the two users, the total Blockchain will be updated with the most recent state of this payment channel. So, the way the Lightning Network works is it enables users to conduct numerous transactions outside of the main Blockchain and then record them as a single one.

Lightning network: Off-chain transactions

This creation of a payment channel including sending BTC may sound a little bit confusing and even difficult. Don’t worry too much about that. Once this technology is widely adopted you won’t need to set up a channel yourself to start using it. Many channels will already be created for you and you just have to connect to the users you need. These channels are also called routes between users of the network. By sending small funds over this network, the system will automatically find the shortest route for you.

Why wasn’t the Bitcoin Blockchain created with this layer from the start? The answer is security. The Bitcoin Blockchain was created in the first place to offer security for sending a large amount of BTC across the network. Microtransactions in the form of a cup of coffee wasn’t a priority from the start. So what I’m saying is that the Lightning Network offers a solution to scalability with sending instant microtransactions. It doesn’t offer the security the underlying Blockchain network has.

Who developed it?

Like every other Blockchain project out there, the project can’t exist without a decent white paper. Joseph Poon and Thaddeus Dryja wrote the initial version of the whitepaper, created in 2015. Nowadays the whitepaper has gone through many iteration cycles and the most recent version can be found here.

There are currently three teams collectively carrying out most of the work on the development of the Lightning Network: Blockstream, Lightning Labs and ACINQ, with input from other members of the Bitcoin community. These three companies are working on their own implementation of the Lightning Network Protocol written in different programming languages. To summarize, three companies are working on their version of the protocol and their implementations are fully interoperable. This means that their solutions can perfectly work with one another.

Currently, the implementation of the Lightning network doesn’t cover Bitcoin only. Other cryptocurrencies are adopting this technology too. Blockchain projects like Stellar, Litecoin, Zcash and even Ethereum are working on it. This means that the technology behind this network is taken seriously and means a huge step forward for this project.

Summarization pros and cons

Like any other innovative project out there which is still in its implementation phase, the outcome of the project has it’s pros and cons. Down below a quick sum up of these points.

Pros

- Transaction speed – Currently when you want to make a transaction over the Blockchain network you have to deal with confirmations. This takes on average about 15 till 30 minutes of waiting time. The Lightning Network will solve this and transactions will be instantaneous no matter how busy the network is. Implemented the right way, the Lightning Network will be a new competitor in the financial marketplace.

- Transaction fees – Microtransactions will be removed from the Blockchain and being handled in payment channels. By doing this the relatively large fees will go away and makes transactions very cheap. This is a huge step forwards in the evolution of the Bitcoin network. By removing and reducing fees to almost zero, Bitcoin can be used as a form of payment within shops, cafes and so on.

- Scalability – According to the Lightning Network projects website, scalability will be a problem of the past. The Lightning network will be capable of sending millions or even billions transactions per second across the network.

- Cross chain atomic swaps – This sounds like some alien buzz-word, but yes it’s a pro and I’ll explain. Like I said earlier in this post, there are currently about 2108 Blockchain networks out there. Currently, these are just isolated networks within the web and there is no interaction between them. The Lightning Network comes with a solution to this. Currently, if you want to send a transaction from let’s say the Ethereum Blockchain to the Bitcoin Blockchain this won’t work without a third party. You have to go to an exchange first to sell Ether and buy Bitcoin. After the order on the exchange has been done, you can make your Bitcoin transaction on the Bitcoin Blockchain. The Lightning Network will make this easier offering a solution as long as both Blockchains use the same cryptographic hash function. By using this technique there is no need for a third party anymore.

- Security and anonymity – The majority of cryptocurrencies out there are not fully anonymous. Transactions between two wallets can be traced and tracked. The Lightning Network removes transactions from Blockchain to payment channels. This will make transactions very hard to trace.

Cons

- Not fully operational – Currently the idea exists on paper and many developers are working on it. Unfortunately there is no working proof-of-concept for using it in a real world application. We just have to sit and wait until real progress is being made.

- Complexity and usability – Currently it’s not clear yet how to use this web of channels and do transactions on it. Also if your transaction is being routed through many channels, eventually the fees will add up.

- Channel caps – To create a new payment channel two users have to send funds(BTC) in it. By doing this the total amount of the channel cannot exceed the limit of the initial deposited funds. Most users don’t owe much BTC and won’t create payment channels. Only the fortunate will which could have a negative impact on the idea of decentralization.

- Hubs – Like explained above, the use of payment channels can create some big nodes which will handle the majority of transactions. These are called hubs and could harm the idea of decentralization. But, it is unlikely that such hubs will be able to make any significant profit of transactions fees.

Latest developments

Like I explained earlier in this post, The Lightning Network is still in the works but with no real-world solution yet. According to their blog on the Lightning website, a new release is coming soon which covers the famous ‘Lightning Loop’ bug. This alpha release will fix this problem. Currently, when users want to send funds to each other this is possible until it reaches the limit(cap) of the channel.

Loop Out Fix

When the limit of a channel is reached, no more funds can be transported on it and users can’t receive funds. This new fix is called ‘Loop Out’ and will allow users to store funds on-chain when the limit is reached. This ‘Loop Out’ feature is non-custodial, the funds can be moved onto any chosen address such as an exchange, a hot-wallet, a cold wallet or a crypto service. There is a maximum of 0.01 BTC per ‘Loop Out’ transaction.

Lightning network conclusion

To summarize a lot of cool stuff is in the works and behind the curtains, a lot of development is going on. One of the examples is ZigZag exchange. At this exchange lightning fast transactions can be done with Bitcoin by using a payment channel. Also you have the option to add their wallet Bitlum as Chrome extension.

Finally, despite the current negative sentiment in the market mostly based on price action, progress in the realization of a functioning payment network is certainly being made.

Related :What is Blockchain?

Disclosure: This post could contain affiliate links. This means I may make a small commission if you make a purchase. This doesn’t cost you any more but it does help me to continue publishing cool and actual content about Bitcoin & Crypto – Thank you for your support!

- How To Know When To Short Crypto? - September 23, 2024

- Want To Make A Living Trading Crypto? - September 21, 2024

- Spot Trading Bitcoin: A Beginners Guide To Profitable Trades - September 19, 2024