Bogus addresses are Bitcoin adressess without known private key. This article covers inaccessible Bitcoins that are lost including price effects.

During the last few years, Bitcoin (BTC) became a recognized asset and it attracted the attention of investors from all over the world.

One of the most interesting things related to this cryptocurrency is related to the inaccessible Bitcoins in the market. Yes, there are millions of lost Bitcoin that may never be accessible again.

In this article, we will explain how it is possible to have inaccessible Bitcoins and how this could affect the network in the future.

Inaccessible Bitcoins – Understanding the Matter

According to a recent report released by Coin Metrics, there are different reasons why Bitcoins can get lost. For example, a user can send funds to an inaccessible address or lose its private keys.

| To prevent you from losing your Bitcoins forever, we wrote another related article. This article covers the Bitcoin seed phrase and how to store it safe. |

Bogus addresses are those Bitcoin addresses that do not have a known private key. Also, users would never be able to access these funds, even if they want to. Many BTC coins have been already sent to these addresses.

There are several bogus addresses in the market and users continue to send money to them. In fact, they keep sending despite knowing there will be no way to have access to the funds in the future.

Bugs in the network causing Bitcoins being lost

At the same time, bugs in the network would also make it possible to reduce the total Bitcoin supply forever. As per the report, some bugs have already increased the number of inaccessible Bitcoins in the market.

MtGox, for example, sent over 2,609 BTC to a bogus script. There is no way to spend these BTC, thus, the funds are lost forever.

What Coin Metrics calls Zombie Coins seems to be the main reason behind most of the inaccessible Bitcoins in the market.

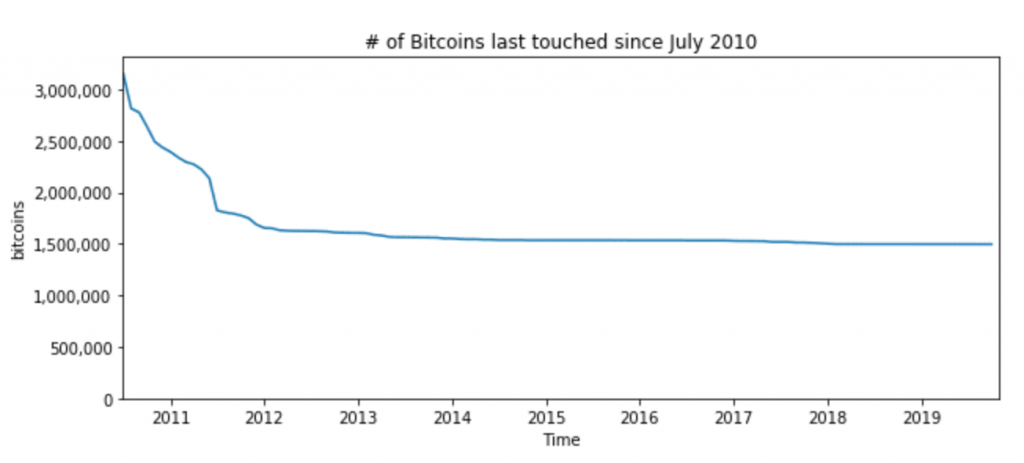

These zombie coins are those Bitcoins that have not moved for a long period of time. According to the report, there are almost 1.5 million BTC that didn’t move since July 2010. Of course, some of these coins belong to Satoshi Nakamoto himself and to other early adopters in the space.

Nonetheless, if these individuals do not have access to the private keys containing these Bitcoins, that means that these coins are lost forever.

At the same time, encumbered coins are also going to have an effect on the Bitcoin network. Additionally, these are coins that could be considered lost because it would be very difficult to move them again.

Several hackers had the possibility to have access to thousands of BTC in the last years. These coins are closely followed by blockchain analysts and bots because they want to understand who is handling them.

Bitcoin investors who got passed away

Another reason why Bitcoins can get lost is the fact that many investors died. Moreover, they died without clarifying where their private keys were or how to access these coins.

Perhaps, the most famous case regarding this issue was the former Quadriga CEO Gerald Cotten. In fact, he passed away in December 2018 without providing information about the private keys of the exchange’s crypto wallet.

Basically, the report shows that there are 1,501,730 BTC that are assumed lost and that may not be accessed.

That means that as of block 600,000, instead of 18,000,000 BTC available to be traded, there were 16,498,270 BTC.

Consequences of Inaccessible Bitcoins on the Network

The total amount of Bitcoin lost is equal to 7.14% of the total Bitcoin supply, which is 21 million.

Bitcoin has an inflation model in which every 210,000 blocks there are fewer BTC issued. This would continue until the 21 million cap BTC is reached in 2140.

Currently, the pace at which new coins are lost in the market is slower than the network inflation. However, this could be different in the future after several Bitcoin halvings take place.

Bitcoin price, deflation and total supply

Eventually, Bitcoin will become a net deflationary asset in the future. This is something that shouldn’t have an immediate effect on the price of the cryptocurrency considering the market seems to have priced it already in.

Bitcoin’s price could be affected by a shock in the demand rather than in a shock in the supply side unless there is a situation in which an entity loses a large amount of BTC.

Nonetheless, a reduction in the total supply of Bitcoin could have a massive effect on the price of the most popular cryptocurrency in the market. Why? Because if there is an increased demand for the asset, there will simply be fewer BTC available to traders and investors.

Finally, companies and individuals must be always sure they properly hold their Bitcoin. This, to reduce to the minimum the number of coins that are lost.

Conclusion

In this article, we explained which are the effects that inaccessible Bitcoins have on the network and why there are BTC coins that are lost forever.

There are several causes that reduce the total supply of Bitcoin, including bogus addresses, bugs, zombie coins, hacks, and many other things.

Moreover, we explained that although a reduction in the total supply of Bitcoin is bullish for the price of the cryptocurrency, this has already been priced in.

Demand-side shocks in the market would end up having a more noticeable effect on Bitcoin than a steadily growing supply reduction.

Disclosure: This post could contain affiliate links. This means I may make a small commission if you make a purchase. This doesn’t cost you any more but it does help me to continue publishing cool and actual content about Bitcoin & Crypto – Thank you for your support!

- 6 Reasons Why most NFTs are Ugly(But Keep Rising in Price) - February 16, 2024

- Best Way to find Upcoming NFT Projects - February 10, 2024

- 10 Ways to earn Crypto Daily on Binance - October 30, 2024

This is not correct, but that’s ok, most people don’t fully understand how the cryptography behind Bitcoin works, and technologists usually don’t write articles this well.

Keep it up Carlos!

In reality, anyone by chance can create a private key that matches an existing address with “lost” bitcoins, even if the private key is not the same, they can spend them!

In fact, there are people right now with special machines trying to get the keys for the first batch of satoshi’s blocks, but right now, this is so hard and slow that mining is more efficient energy wise.

As computers get more powerful, they will be able to crack those old lost keys (Not quantum computers, Bitcoin is quantum resistant in it’s vast majority) and those “lost” bitcoins will be recovered.

🙂